Dark Mode

Listen to this article

Bavariacard

Poker is oftentimes an extremely exciting game, especially when the stakes are high and only a few players remain at the table to secure the jackpot. A special tactic in this card game is the so-called pokerface, meaning the deceptive presentation of a high-quality card collection hidden to others. This is intended to deceive opponents psychologically in order to make them abandon the game prematurely, all while having their stakes remain on the poker table. One could almost believe that such a poker-faced game took place in 2019 with various members of Germany's Chancellery, the German Ministry of Finance, former German Defense Minister Karl-Theodor zu Guttenberg, and representatives of the online payment service provider Wirecard, which was listed on Germany's DAX stock exchange at that time.

The Wirecard company was founded in 1999 in the inner city district Lehel of the Bavarian capital Munich, originally and from now on providing software that would act as an intermediary between credit card companies, online retailers and Internet customers. In 2000, the still young Wirecard company received a double-digit million amount as start-up capital under then founder Detlev Hoppenrath, who also promoted Jan Marsalek to the position of Director of Information Technology - an Austrian national who was initially employed by Wirecard at the tender age of 20. When an internal IT project led by Marsalek failed, resulting in a loss of around a million euros, management consultancy firm KPMG was asked to cleanup the mess. Another Austrian national in KPMG's team drew the attention of Wirecard's management and was asked to swing over to Wirecard: Markus Braun.

In May 2001, the company moved to the very telling Munich outer district named Aschheim. Marsalek is not fired, but kept on track and from then on formed high-flying projects together with his Austrian colleague Braun. For example in November 2001, when Braun's and Marsalek's laptops were stolen during an alleged theft in which, according to Wirecard, more or less the entire corporate technology was taken away. Wirecard was now an easy prey for the porn website operator EPM AG, which rebranded itself as EBS Holdings and took over the Aschheim-based company shortly after it had filed for bankruptcy. At the same time of the EBS AG takeover, Wirecard founder Hoppenrath filed a criminal complaint in January 2002 against the new board at Munich's Public Prosecutor's Office,he suspected that corporate insiders were responsible for the technology theft. Understandable, considering that Braun was informed by porn company founder Schlichtegroll in October 2001 already that there was a strong interest in a Wirecard takeover. Wirecard's ex-founder Hoppenrath officially left the newly formed company by the end of 2001, the tech provider now ignites its growth rockets after Munich's prosecutors either closed the investigation or, as is often the case there, selectively rejected to investigate.

The next Munich stunt show with Austrian support was not long in the coming. In January 2005, Wirecard was transformed into a publicly traded stock corporation through a so-called reverse IPO. Similar to viruses, a host was used, in this case the ingenious call center operator InfoGenie Europe AG based in Berlin. A month earlier, InfoGenie AG decided to be taken over by Wirecard entirely and in that way prevented a total disappearance from Germany's TecDax due to lack of success. Wirecard issued a capital increase by contribution in kind (!) and voila, InfoGenie Europe AG was renamed into Wire Card AG in 2005 - which was now even listed on Germany's TecDax market. Porn operator Schlichtegroll joined the supervisory board, Markus Braun has been a member of the board from the beginning, from 2010 on his Austrian colleague Jan Marsalek joined the board, too. Genius !

Only two years after the host was absorbed and Wirecard had converted into a stock corporation, Wirecard Asia Pacific was founded in Singapore in 2007, the origin of the infamous end of the company about a decade later. As early as May of 2008, an anonymous web user named 'memyselfandi007' posted on the Wallstreet-Online Internet forum about financial inconsistencies in connection with Wirecard's takeover of Trustpay AG, a company that was also based in a Munich suburb:

On the basis of these statements by 'memyselfandi007', which were read many million times on the web, the German Protection Association of Investors (SdK) takes action and accuses Wirecard of falsifying its accounts, leading Wirecard to hire auditing company Ernst & Young to prepare a special financial audit for 2007. In the meantime, an important group of investors made the balance sheet issues public, which caused Wirecard's share prices to plummet and the company to file another criminal complaint at Munich's Public Prosecutor's Office. There however, one was not particularly interested in the many obvious Wirecard balance sheet falsifications, but instead took two SdK employees into custody and sentenced them later for other offenses. Munich's police did also not hesitate much to investigate the internet forum author 'memyselfandi007' for a while.

Three years later, Munich's Public Prosecutor's Office had to take action again in 2010, this time because allegedly false reports from a US financial whistleblower organisation named Goldman, Morgenstern & Partners (GoMoPa)would "damage Wirecard in an unjustified manner". Wirecard itself was apparently not the complainant here, but already back then Germany's Federal Financial Supervisory Authority BaFin, based in Frankfurt and Bonn. The initial trigger in 2010 was the indictment and later conviction of German national Michael Schuett by law enforcement authorities in Florida, USA. Schuett was convicted for engaging in illegal money transactions of around 70 million USD, the majority generated through online poker games and mailed as regular checks by Schuett to thousands of North American poker game winners.

GoMoPa initially stated that Schuett mentioned Wirecard as one of his money providers on the European side. Under somewhat dubious circumstances, Schuett's statements were changed a little later, only to be withdrawn entirely. Meanwhile, Wirecard's share price fell by a whopping 30%, which was apparently much more important to Munich's public prosecutors and also to BaFin than Wirecard's connections in England, where Wirecard executives were indirectly in contact with Michael Schuett through a company called Brinken Merchant Inc. For two years, Munich's public prosecutors did not investigate Wirecard UK, but instead GoMoPa, this until 2012, which now raises the urgent question of why Munich's public prosecutors did not investigate any further issues regarding Wirecard's obvious connections to Schuett in Florida at that time:

Things turned out to be quite dubious in Munich in 2015 as well. Based on tips from the US Department of Justice, Wirecard's subsidiary Click2Pay was investigated. A chief detective at Munich's police headquarters took a close look at four Wirecard managers including Marsalek for suspicion of aiding and abetting illegal gambling. Numerous activities were encountered in which Click2Pay was used. An application for a search warrant of Wirecard's headquarters in Aschheim was delivered to Munich's District Court in August 2015. However, only a few weeks later, a public prosecutor from Munich rejected the case in September 2015 entirely. A closer look at Wirecard's premises was "unsubstantiated", according to the state attorney. The US Justice Department was not satisfied it seemed, since it inquired more explicitly a few weeks later again. Munich's law enforcement finally and apparently carried out a "raid" of Wirecard's office buildings in December 2015, at least according to official documents and in a "strictly confidential" way.

The next, very Bavarian investigation by Munich's public prosecutors regarding Wirecard began in 2016, when another report about Wirecard's practises with reference to a takeover of India-based 'GI Retail' and many other corrupt revelations brought the stock prices into a free fall.In December 2018, Munich's public prosecutors issued a penalty for market manipulations after previous investigations and prosecutions. Not against Wirecard, but instead against Matthew Earl's Zatarra report, and with him also against 37 other "suspects" who were "targeted" by Munich's prosecutors for various Wirecard stock dealings. The British stock briefing publisher Fraser Perring agreed to pay a five-figure sum more or less voluntarily to prevent higher convictions. Matthew Earl was personally persecuted.

In 2018, Wirecard replaced scandalous Commerzbank on Germany's major stock market DAX. Only when Wirecard's balance sheet falsifications were seriously investigated far away from Munich and Germany came the corrupt connections that later even extended to Germany's Chancellery in Berlin into light. In a series of reports about Wirecard, assembled with the heroic help of Wirecard's former legal head for the Asia-Pacific region and whistleblower Pav Gill, Financial Times journalist Dan McCrum piled up Wirecard's fraudulous manipulations from the end of January 2019 on. So much that he was not only persecuted personally, but that the police in Singapore broke into Wirecard's branch offices there on February 8, 2019 to confiscate documents and computers. As usual, Wirecard's management team in Aschheim responded with a criminal complaint against the Financial Times. Munich's public prosecutor's office actually did open an investigation into Financial Times journalists for market manipulation, this also after being pressured by Germany's BaFin; an investigation that was officially not terminated by Munich's scandalous public prosecutors before September 2020.

When the Financial Times stood by its allegations even in October 2019, Wirecard arranged for a special review by financial auditors KPMG, which some time later announced to an astonished financial world that it was embarrassingly impossible to make any clear statements about Wirecard's third-party businesses. Wirecard postponed the publication of its 2019 annual report and even felt confirmed by the partly scandalous KPMG results. It was not until June 18, 2020 that Wirecard finally admitted there was "insufficient evidence of available bank balances in trust accounts in the Philippines", amounting to a whopping 1.9 billion (not million!) Euros simply missing. Wirecard's share price plummeted within 48 hours to nearly 0 Euros and sustainably destroyed around 20 billion Euros in market value, leaving behind many disappointed investors.

Braun was put into custody, Marsalek has since disappeared. A September 2020 report by Munich's Sueddeutsche Zeitung that reads almost like a conspiracy theory tells that Marsalek was reported to be in bed with Austria's Constitution Protection Agency (BVT), and that he fled to Minsk, Belarus on the evening of June 19, 2020 by the use of a private plane. That's where he was apparently also seen for the last time. Things become a bit clearer when considering that Marsalek had indeed strong ties to the Austrian BVT and was very close to Russia, in a literal sense.

Things become a bit clearer when considering that Marsalek had indeed strong ties to the Austrian BVT and was very close to Russia, in a literal sense.

Both Braun and Marsalek were so-called "Senators" of the Austrian-Russian Friendship Society (ÖRFG) in Vienna, Wirecard transferred around 10,000 Euros to that group annually. Around 2017, an unspecified "German group of experts" asked the Austrian Ministry of Defense whether they wanted to setup a mercenary group in southern Libya in order to stop the mass migration flows to the North. The responsible government official for the project at the Austrian Ministry of Defense was a board member of the friendly Russian-Austrians in Vienna (ÖRFG), they wanted Marsalek as a manager for the project which was never realised. Also, Marsalek resided in a luxurious house literally on the other street side of the Russian Consulate General in the Bavarian capital Munich. The property was not rented by Marsalek himself, but by an IT investment company named 'IMS Capital', whose director Munich-born Marsalek friend and online tourism portal investor Aleksandar Vucak is/was.

Vucak was indirectly mentioned in a May 2018 report by auditing firm Rajah & Tann already, commissioned by Wirecard because of incriminating statements from a Singapore whistleblower. The 'Emerging Markets Investment Fund 1A' (EMIF IA) based in Mauritius bought Indian-Asian former lottery company 'Hermes Tickets' in September 2015 for 37 million USD, founders Santiago Martin and Usman Fayaz were not only convicted for illegal business activities, but also had various business connections to Liberia. A few weeks later, at the end of October 2015, Wirecard officially announced it would acquire parent company 'GI Retail', mentioned in detail in the Zatarra report, for 230 million Euros in cash plus 110 million in earnouts. Another few months later, Wirecard formally acquired Hermes Tickets from EMIF for 340 million USD, GI Retail's most valuable business part. Financial Times journalist Dan McCrum and others accused Wirecard of so-called "round-tripping", Hermes minority shareholders filed criminal charges because they were paid out based on the 37 million deal with EMIF. Around the same time in November 2015, EMIF announced it had acquired a travel company from India called 'Orbit' for 180 million USD, in mid 2017 also 'Goomo.com' for 50 million USD. Director at Goomo (Hindi for travel) at that time in 2017 was Aleksandar Vucak.

Vucak is now in charge of a company named 'Bionovate Technologies' with business address in Cham, Switzerland, where he was made Director, CEO, CFO, Secretary and Treasurer in 2020. He follows a number of previously replaced lawyers in the same position at Bionovate, including corporate lawyer and former San Diego, California prosecutor Marc Applbaum. Bionovate claims to have an office in China, shareholders located in the Virgin Islands, a former company president from Mexico, a former CEO from China as well as a strange previous business address in Israel. The until now financially low profile company came up with a COVID testing kit for Smartphones in 2021, which begs the question why so many elite intelligence circles were apparently involved in the Wirecard matter.

Marsalek also hired management consultancy company 'Gradus Proximus Advisory GmbH' from Vienna, Austria to prepare weekly reports on social media observations related to Wirecard. Thomas Zach, founder of Gradus Proximus and close aide of Austria's former Interior Minister Strasser, apparently also arranged for a contact to Israeli IT professional Avi Rosen. The encryption technology expert has close ties to Israeli secret services, Rosen and Marsalek apparently met on February 24, 2017 in the Bavarian capital, five days after Munich's Security Conference had ended there. According to emails, the two intended to setup a joint business venture:

Also interesting is that at Wirecard's annual shareholder meeting on June 19, 2019, exactly one year prior to the balance sheet katastrophe, Thomas Eichelmann was elected to Wirecard's supervisory board. Eichelmann previously had not only been CFO of Germany's Stock Exchange Corporation but also chairman of the supervisory board of Germany's construction giant Hochtief AG until September 2014, where Russian oligarch Oleg Deripaska made a big investment around 2007 in order to coordinate gigantic construction projects for the Russian 2014 winter olympics city Sochi. In addition, another Austrian became member of Wirecard's supervisory board from 2010 on: Stefan Klestil, whom Eichelmann certainly knew well from the EU-funded IT-investment company Speedinvest. There, Stefan Klestil is/was a full and Eichelmann a limited partner. Stefan Klestil, son of former and 2004 died Austrian Federal President Thomas, whose funeral was attended by Russian President Vladimir Putin, has a stepmother who, after the death of her 1998 married husband, was made Austrian Ambassador to Moscow from 2009 on, coincidentally also until 2014.

Special attention should also be paid to Christopher Bauer, who acted as a Wirecard partner from Manila and was responsible for around a fifth of all sales. Bauer's family in Germany announced in August 2020 that he had allegedly died of heart failure in the Philippines, no official death certificate was issued according to the authorities there.

In October 2020, the German Bundestag decided to investigate the Wirecard matter. During this investigation, a whole new series of events surfaced, which to this day are either suppressed or completely ignored - almost like those at Munich's Public Prosecutor's Office. The methods used at some highest political levels and with the help of Bavarian brute force aimed at making Wirecard grow under all and any circumstances, it seems. The political debris of the Wirecard scandal also proofs that Germany had almost entirely missed the emergence of the IT industry in the decades before, with the rare exception of SAP maybe.

Details show that Germany's Finance Ministry in Berlin was informed already on February 19, 2019 about Wirecard's fraudulent acts. State Secretary Kukies told Finance Minister Olaf Scholz's employees back then that their sub-organisation BaFin was "investigating [Wirecard] in all directions". It is astonishing that even by November 2019, when all financial flags regarding Wirecard were already in deep red, Kukies met with Wirecard's CEO Markus Braun for breakfast in Aschheim, apparently chatting about startups and cryptoassets there.

Perhaps all this was possible because of German Chancellor Merkel's trip to China two months earlier, where the last and final act of the Wirecard grand poker game took place. In discussions with Chinese business representatives in September 2019 in China, the German Chancellor unabashedly promoted Wirecard, which shortly after made an offer to buy the Chinese online payment provider AllScore.Germany's former national intelligence coordinator Klaus-Dieter Fritsche enabled Wirecard a contact with Berlin's chancellery after he learned that CEO Markus Braun "regularly goes in and out of the Austrian chancellery" in Vienna, this via the think tank "Think Austria", initiated by Austrian chancellor Sebastian Kurz to which head of Munich's Security Conference Wolfgang Ischinger was appointed to as well, by the way. In addition, the former German secret service man Bernd Schmidbauer stated that Wirecard's technology would have enabled various intelligence agencies to track worldwide money flows. The technology supposed to have been an ideal form of surveillance that was on purpose also misused, according to Schmidbauer - also for money laundering.

During her trip to China in September 2019, Merkel also visited the glorious city of Wuhan by the way, a whole three months before the first COVID cases were reported there. Was the German Chancellor aware that 120 German Bundeswehr soldiers together with 90 medical Chinese army members carried out the military exercise 'Combined Aid' only a few months earlier in July 2019 in Feldkirchen, a small town not too far from Munich ? The German-Chinese aligned military excercise on Bavarian soil was training on how to respond to a virus pandemic for 14 days.

Long before the Chancellor's trip to China, Karl-Theodor zu Guttenberg, Germany's former Bavarian-born defense minister who lives in the US knocked on many doors. Via his New York based company Spitzberg Partners, zu Guttenberg was brought in as a lobbyist for Wirecard to enable and back up the Chinese AllScore deal. Already in September 2018, zu Guttenberg contacted the new German ambassador in Beijing through his high-profile consulting firm to promote Wirecard and its expansion in China. A first meeting was made possible for Wirecard in Beijing on October 29, 2018, a much more important meeting took place there on January 23, 2019. Days before Merkel's trip to China, zu Guttenberg had a meeting "with his former boss [Merkel] on September 3, 2019", as one of his emails details. Still in April 2020, in a written guest contribution to major German news outlet FAZ, zu Guttenberg was personally advocating for a banning of short sellers. Strangely, his name was allegedly also listed on a Wirecard campaign to promote short seller bans by German PR agency Edelmann.

On February 18, 2019, during the peak of zu Guttenberg Chinese efforts and coincidentally only one day after Munich's 2019 Security Conference had ended, Germany's regulatory banking authority BaFin issued a short sale ban to prevent financial speculations on Wirecard's falling share prices. At the same time, Munich's prosecutors announced they would now investigative Financial Times journalists, including Dan McCrum. Two months later, on April 19, 2019, BaFin announced that the eight weeks earlier imposed short sale ban had now expired, which is when BaFin also filed a criminal complaint at Munich's public prosecutor's office for alleged "market manipulations".

Exactly on the same February 18, 2019, coincidentally one day after the end of Munich's Security Conference in the Hotel Bayerischer Hof, Wirecard in Aschheim was informed about a list of 343 suspicious financial transactions that were identified as potential money launderings by Commerzbank, an executing partner of Wirecard's banking arm. In the Commerzbank email, Wirecard was asked to comment on these suspicious transactions, which was probably not considered as really important any more in view of the short sale ban imposed by BaFin on exactly the same February 18, 2019. Commerzbank forwarded the list eight days later to Germany's anti money laundering unit called FIU, which, according to strange statements by FIU managers in the Wirecard Bundestag committee from June 8, 2021, did not inform Munich's public prosecutors about these 343 transactions until July 2020, while at the same time providing "seven foreign supervisory authorities with spontaneous information" in advance.

It is obvious that the public prosecutors in Munich rushed to investigate all possible players at the poker table aside from the actual corrupt ones, circumstances which lead to a special invitation for important justice officials from Munich and Bavaria to testify in front of the Bundestag Committee. At the end of January 2021, the Bavarian Minister of the Interior appears in front of the Wirecard committee, who dares to mention to an astonished audience that it "would make sense for a company like Wirecard AG to be the subject of extensive supervision".

It is also unveiled that a former Bavarian State Police President was employed by Wirecard from 2014 on. He supported a number of high-level contacts with politicians and consulates, including various police authorities. The retired and formerly highest police officer in Bavaria had multiple consulting contracts with various companies running. On January 29, 2021, one of Munich's many public prosecutors appeared in front of the German Bundestag committee. She stated among other that Marsalek's lawyer was "contacted" by her when the missing 1.9 billion Euros on Wirecard's balance sheets were confirmed mid 2020. She "invited" him to visit her Public Prosecutor's Office, which apparently happened only a week later since Wirecard told her that Mr. Marsalek was once again on a business trip. A first and quick inspection of the Prinzregentenstrasse 61 residence was carried out by Munich's public prosecutors on June 5, 2020, a real examination and search was not carried out until July 1, 2020, Marsalek and Vucak's villa was left untouched for almost a month.

A somewhat dubious affidavit from early 2019 shows that a former drug offender was apparently asked by Wirecard to state to Munich's public prosecutors that the Financial Times had allegedly offered Bloomberg News Service 6 million Euros. This, according to the affadavit, to demonstrate that Bloomberg was not only forced to run with FT-McCrum's reporting, but also that Bloomberg would blackmail Wirecard now. The affidavit was never really signed. However, Munich's public prosecutors wrote an important note to Germany's banking supervisory authority and even explained the affadavit in a more detailed telephone call to Bafin.

Munich's prosecutors gave also no prosecutorial importance to extensive investigations by local Munich tax authorities Finanzamt, which they met with in the first month of 2020. In a protocol dated January 24, 2020, the state financial auditors wrote that "the disputed issue was presented [to Munich's public prosecutors] and it was discussed if the Financial Times allegations had to be investigated". Munich's state attorneys stated still in January of 2020 that "in summary,there is no sufficient suspicion to justify the initiation of criminal proceedings here", according to the protocol. This all while Financial Times journalists were investigated by Munich's public prosecutors until September 2020. Noteworthy is also that at a second appearance of Munich's public prosecutor at the Bundestag committee in mid February 2021, the testimony could not be recorded due to technical problems and will most likely not be included in the final committee report.

The financial auditors at Ernst & Young (EY) appear at the center of the fraud, since they are accused of having signed off Wirecard's balance sheets too easily from 2015 on despite early and serious doubts about the company's proof of work. Wirecard's third-party business partners in Asia were entitled to receive securities from the Aschheim AG, allegedly via overseas trust accounts which continued to grow over the years, ultimately amounting to a whopping 1.9 billion euros according to the balance sheets. EY refused to certify their audit for 2019 only when proof of such trusted money accounts was more or less impossible in 2020. Strange also that auditors/laywers at EY themselves had the idea of utilizing these offshore trust accounts and recommended them to Wirecard's former Chief Legal Officer Burkhard Ley already in 2016. Munich's public prosecutor's office would not begin their investigations specifically targeted at EY until December 2020. In addition, a special audit investigator was appointed by the Bundestag committee.

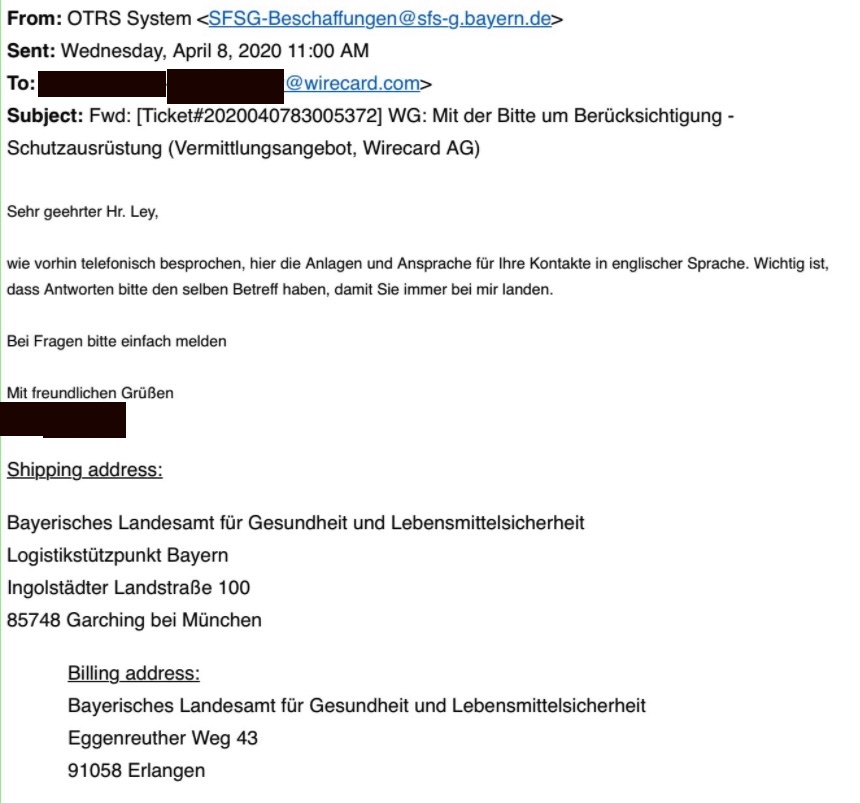

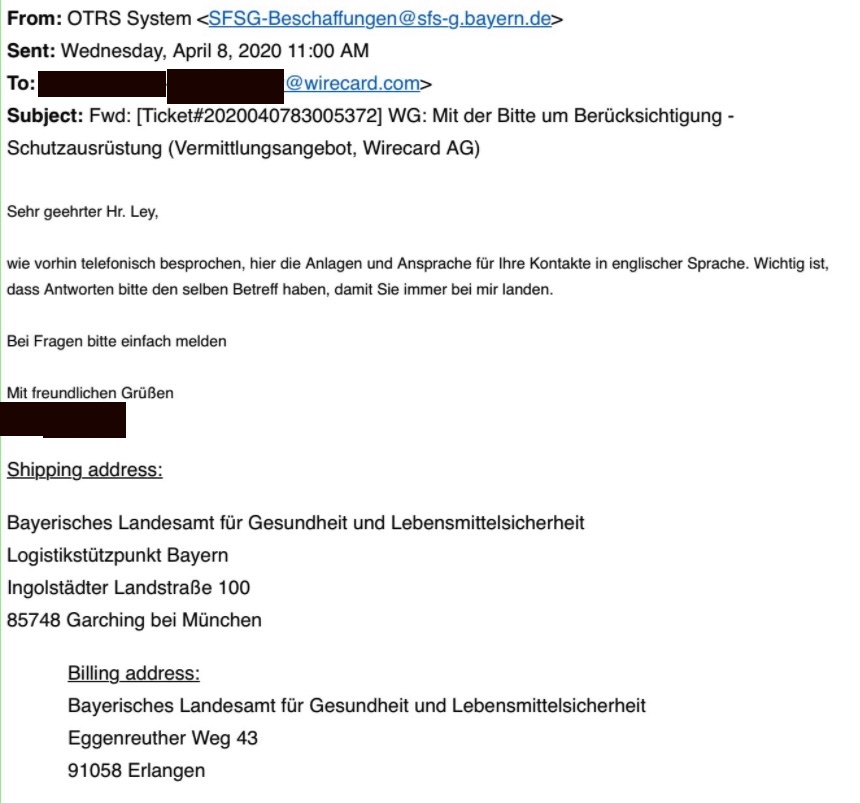

Interesting also that Wirecard offered the Bavarian State still in April of 2020 a deal to purchase a larger quantity of anti Coronavirus face masks, it seems:

The top management of Munich's premier soccer club FC Bayern was also impressed by Wirecard, since they were literally neighbours in Munich. At the end of 2019, a three-year contract was signed between Wirecard and FC Bayern's top league Basketball team, which was about to receive a whopping 1.5 million Euros from the Aschheim AG. Wirecard was offered to become a so-called platinum partner right on time for the Basketball playoffs. The cooperation was announced on June 5, 2020, around two weeks before the officially admitted balance sheet disaster. Also, the former Bavarian state police president who was on Wirecard's payroll stated in the Bundestag investigational committee on January 28, 2021 that he participated in a meeting with Karl-Theodor zu Guttenberg at picture perfect Tegernsee. There at Tegernsee, a preferred residence for FC Bayern management cadres, some top league soccer players and local Bavarian politicians, "an attack strategy for Wirecard was explored, abstractly" and apparently in a gemuetlich get together.

The German Chancellery is also known for condemning new technologies, social media and even the Internet itself too easily and in a generalized way for uncovering facts about corruption. Investigative journalists are intentionally criminalised. If Merkel's advisors would have carefully researched Wirecard's takeover candidate in China, they would have been able to find out that there were also red flags all over AllScore, especially with one of its parent companies named 'Joy Dragon Consultants Limited', which was incorporated on June 12, 2019, it seems:

That no one had any idea of Wirecard's and even AllScore's rather rough past in all these high-level political get togethers, conversations and interactions seems unreal. The fact that nobody had truly been informed about the financial problems that were boiling on Wirecard's balance sheets was clearly staged by players from Munich.

Or was it all just a daring poker game ?

The Wirecard company was founded in 1999 in the inner city district Lehel of the Bavarian capital Munich, originally and from now on providing software that would act as an intermediary between credit card companies, online retailers and Internet customers. In 2000, the still young Wirecard company received a double-digit million amount as start-up capital under then founder Detlev Hoppenrath, who also promoted Jan Marsalek to the position of Director of Information Technology - an Austrian national who was initially employed by Wirecard at the tender age of 20. When an internal IT project led by Marsalek failed, resulting in a loss of around a million euros, management consultancy firm KPMG was asked to cleanup the mess. Another Austrian national in KPMG's team drew the attention of Wirecard's management and was asked to swing over to Wirecard: Markus Braun.

In May 2001, the company moved to the very telling Munich outer district named Aschheim. Marsalek is not fired, but kept on track and from then on formed high-flying projects together with his Austrian colleague Braun. For example in November 2001, when Braun's and Marsalek's laptops were stolen during an alleged theft in which, according to Wirecard, more or less the entire corporate technology was taken away. Wirecard was now an easy prey for the porn website operator EPM AG, which rebranded itself as EBS Holdings and took over the Aschheim-based company shortly after it had filed for bankruptcy. At the same time of the EBS AG takeover, Wirecard founder Hoppenrath filed a criminal complaint in January 2002 against the new board at Munich's Public Prosecutor's Office,

As early as May of 2008, an anonymous web user named 'memyselfandi007' posted on the Wallstreet-Online Internet forum about financial inconsistencies in connection with Wirecard's takeover of Trustpay AG.

The next Munich stunt show with Austrian support was not long in the coming. In January 2005, Wirecard was transformed into a publicly traded stock corporation through a so-called reverse IPO. Similar to viruses, a host was used, in this case the ingenious call center operator InfoGenie Europe AG based in Berlin. A month earlier, InfoGenie AG decided to be taken over by Wirecard entirely and in that way prevented a total disappearance from Germany's TecDax due to lack of success. Wirecard issued a capital increase by contribution in kind (!) and voila, InfoGenie Europe AG was renamed into Wire Card AG in 2005 - which was now even listed on Germany's TecDax market. Porn operator Schlichtegroll joined the supervisory board, Markus Braun has been a member of the board from the beginning, from 2010 on his Austrian colleague Jan Marsalek joined the board, too. Genius !

Only two years after the host was absorbed and Wirecard had converted into a stock corporation, Wirecard Asia Pacific was founded in Singapore in 2007, the origin of the infamous end of the company about a decade later. As early as May of 2008, an anonymous web user named 'memyselfandi007' posted on the Wallstreet-Online Internet forum about financial inconsistencies in connection with Wirecard's takeover of Trustpay AG, a company that was also based in a Munich suburb:

Only half of the purchase price [48 million euros] was paid (financed by a capital increase !!!), the rest will follow in 2008. Whoever is the seller of this portfolio seems to be making a good deal of money, he gets at least three times as much of the book value before back payments. You can google the acquired Trustpay AG any way you want, apart from the Wirecard News you won't find any information. Nothing at all. And for that 40 million ? It looks like a systematic plundering of the capital increases, especially if you consider that the acquired company, like Wirecard, is based in Grassbrunn.

(Anonymous blogger memyselfandi007 on Wallstreet-Online dated May 1, 2008)

(Anonymous blogger memyselfandi007 on Wallstreet-Online dated May 1, 2008)

On the basis of these statements by 'memyselfandi007', which were read many million times on the web, the German Protection Association of Investors (SdK) takes action and accuses Wirecard of falsifying its accounts, leading Wirecard to hire auditing company Ernst & Young to prepare a special financial audit for 2007. In the meantime, an important group of investors made the balance sheet issues public, which caused Wirecard's share prices to plummet and the company to file another criminal complaint at Munich's Public Prosecutor's Office. There however, one was not particularly interested in the many obvious Wirecard balance sheet falsifications, but instead took two SdK employees into custody and sentenced them later for other offenses. Munich's police did also not hesitate much to investigate the internet forum author 'memyselfandi007' for a while.

Three years later, Munich's Public Prosecutor's Office had to take action again in 2010, this time because allegedly false reports from a US financial whistleblower organisation named Goldman, Morgenstern & Partners (GoMoPa)

Meanwhile, Wirecard's share price fell by a whopping 30%, which was apparently much more important to Munich's public prosecutors and also to BaFin than Wirecard's connections in England.

GoMoPa initially stated that Schuett mentioned Wirecard as one of his money providers on the European side. Under somewhat dubious circumstances, Schuett's statements were changed a little later, only to be withdrawn entirely. Meanwhile, Wirecard's share price fell by a whopping 30%, which was apparently much more important to Munich's public prosecutors and also to BaFin than Wirecard's connections in England, where Wirecard executives were indirectly in contact with Michael Schuett through a company called Brinken Merchant Inc. For two years, Munich's public prosecutors did not investigate Wirecard UK, but instead GoMoPa, this until 2012, which now raises the urgent question of why Munich's public prosecutors did not investigate any further issues regarding Wirecard's obvious connections to Schuett in Florida at that time:

Ordinary residents of Consett [in England] were paid to serve as directors of hundreds of companies by Brinken Merchant Incorporations (BMI), a Simon Dowson-run, locally-based company. BMI shareholders included Patrick Mosbach, a former Wirecard sales executive, and Brigette Axtner, executive vice president for digital sales at Wirecard ... In 2009, the US Secret Service found that Bluetool Limited, a company that had a local teacher acting as a director, breached money-laundering rules. Michael Schuett, a German citizen, was jailed in the US after admitting running an unlicensed money transmitting business. He was found to have channelled $70 million from Europe to Florida, including via Bluetool and Wirecard.

(Report on Wirecard UK from 2020)

(Report on Wirecard UK from 2020)

Things turned out to be quite dubious in Munich in 2015 as well. Based on tips from the US Department of Justice, Wirecard's subsidiary Click2Pay was investigated. A chief detective at Munich's police headquarters took a close look at four Wirecard managers including Marsalek for suspicion of aiding and abetting illegal gambling. Numerous activities were encountered in which Click2Pay was used. An application for a search warrant of Wirecard's headquarters in Aschheim was delivered to Munich's District Court in August 2015. However, only a few weeks later, a public prosecutor from Munich rejected the case in September 2015 entirely. A closer look at Wirecard's premises was "unsubstantiated", according to the state attorney. The US Justice Department was not satisfied it seemed, since it inquired more explicitly a few weeks later again. Munich's law enforcement finally and apparently carried out a "raid" of Wirecard's office buildings in December 2015, at least according to official documents and in a "strictly confidential" way.

The next, very Bavarian investigation by Munich's public prosecutors regarding Wirecard began in 2016, when another report about Wirecard's practises with reference to a takeover of India-based 'GI Retail' and many other corrupt revelations brought the stock prices into a free fall.

Only when Wirecard's balance sheet falsifications were seriously investigated far away from Munich and Germany came the corrupt connections that later even extended to Germany's Chancellery in Berlin into light.

In 2018, Wirecard replaced scandalous Commerzbank on Germany's major stock market DAX. Only when Wirecard's balance sheet falsifications were seriously investigated far away from Munich and Germany came the corrupt connections that later even extended to Germany's Chancellery in Berlin into light. In a series of reports about Wirecard, assembled with the heroic help of Wirecard's former legal head for the Asia-Pacific region and whistleblower Pav Gill, Financial Times journalist Dan McCrum piled up Wirecard's fraudulous manipulations from the end of January 2019 on. So much that he was not only persecuted personally, but that the police in Singapore broke into Wirecard's branch offices there on February 8, 2019 to confiscate documents and computers. As usual, Wirecard's management team in Aschheim responded with a criminal complaint against the Financial Times. Munich's public prosecutor's office actually did open an investigation into Financial Times journalists for market manipulation, this also after being pressured by Germany's BaFin; an investigation that was officially not terminated by Munich's scandalous public prosecutors before September 2020.

When the Financial Times stood by its allegations even in October 2019, Wirecard arranged for a special review by financial auditors KPMG, which some time later announced to an astonished financial world that it was embarrassingly impossible to make any clear statements about Wirecard's third-party businesses. Wirecard postponed the publication of its 2019 annual report and even felt confirmed by the partly scandalous KPMG results. It was not until June 18, 2020 that Wirecard finally admitted there was "insufficient evidence of available bank balances in trust accounts in the Philippines", amounting to a whopping 1.9 billion (not million!) Euros simply missing. Wirecard's share price plummeted within 48 hours to nearly 0 Euros and sustainably destroyed around 20 billion Euros in market value, leaving behind many disappointed investors.

Braun was put into custody, Marsalek has since disappeared. A September 2020 report by Munich's Sueddeutsche Zeitung that reads almost like a conspiracy theory tells that Marsalek was reported to be in bed with Austria's Constitution Protection Agency (BVT), and that he fled to Minsk, Belarus on the evening of June 19, 2020 by the use of a private plane. That's where he was apparently also seen for the last time.

Munich's Prinzregentenstraße 61.

Both Braun and Marsalek were so-called "Senators" of the Austrian-Russian Friendship Society (ÖRFG) in Vienna, Wirecard transferred around 10,000 Euros to that group annually. Around 2017, an unspecified "German group of experts" asked the Austrian Ministry of Defense whether they wanted to setup a mercenary group in southern Libya in order to stop the mass migration flows to the North. The responsible government official for the project at the Austrian Ministry of Defense was a board member of the friendly Russian-Austrians in Vienna (ÖRFG), they wanted Marsalek as a manager for the project which was never realised. Also, Marsalek resided in a luxurious house literally on the other street side of the Russian Consulate General in the Bavarian capital Munich. The property was not rented by Marsalek himself, but by an IT investment company named 'IMS Capital', whose director Munich-born Marsalek friend and online tourism portal investor Aleksandar Vucak is/was.

Vucak was indirectly mentioned in a May 2018 report by auditing firm Rajah & Tann already, commissioned by Wirecard because of incriminating statements from a Singapore whistleblower. The 'Emerging Markets Investment Fund 1A' (EMIF IA) based in Mauritius bought Indian-Asian former lottery company 'Hermes Tickets' in September 2015 for 37 million USD, founders Santiago Martin and Usman Fayaz were not only convicted for illegal business activities, but also had various business connections to Liberia. A few weeks later, at the end of October 2015, Wirecard officially announced it would acquire parent company 'GI Retail', mentioned in detail in the Zatarra report, for 230 million Euros in cash plus 110 million in earnouts. Another few months later, Wirecard formally acquired Hermes Tickets from EMIF for 340 million USD, GI Retail's most valuable business part. Financial Times journalist Dan McCrum and others accused Wirecard of so-called "round-tripping", Hermes minority shareholders filed criminal charges because they were paid out based on the 37 million deal with EMIF. Around the same time in November 2015, EMIF announced it had acquired a travel company from India called 'Orbit' for 180 million USD, in mid 2017 also 'Goomo.com' for 50 million USD. Director at Goomo (Hindi for travel) at that time in 2017 was Aleksandar Vucak.

Vucak is now in charge of a company named 'Bionovate Technologies' with business address in Cham, Switzerland, where he was made Director, CEO, CFO, Secretary and Treasurer in 2020. He follows a number of previously replaced lawyers in the same position at Bionovate, including corporate lawyer and former San Diego, California prosecutor Marc Applbaum. Bionovate claims to have an office in China, shareholders located in the Virgin Islands, a former company president from Mexico, a former CEO from China as well as a strange previous business address in Israel. The until now financially low profile company came up with a COVID testing kit for Smartphones in 2021, which begs the question why so many elite intelligence circles were apparently involved in the Wirecard matter.

Marsalek also hired management consultancy company 'Gradus Proximus Advisory GmbH' from Vienna, Austria to prepare weekly reports on social media observations related to Wirecard. Thomas Zach, founder of Gradus Proximus and close aide of Austria's former Interior Minister Strasser, apparently also arranged for a contact to Israeli IT professional Avi Rosen. The encryption technology expert has close ties to Israeli secret services, Rosen and Marsalek apparently met on February 24, 2017 in the Bavarian capital, five days after Munich's Security Conference had ended there. According to emails, the two intended to setup a joint business venture:

Marsalek and Rosen met for the first time in Munich at the end of 2016, and again in February 2017. E-mails proof that both times Thomas Zach was involved. For the second meeting on February 24, 2017, Zach had also prepared an agenda and sent it to both Rosen and Marsalek. “Shall we start at 9am and see how far we come until lunchtime ?“, he asked both in an email on February 13, 2017. As far it can be reconstructed, Marsalek and Rosen were considering to establish a business joint venture.

Article on profil.at dated Februar 6, 2021

Article on profil.at dated Februar 6, 2021

Also interesting is that at Wirecard's annual shareholder meeting on June 19, 2019, exactly one year prior to the balance sheet katastrophe, Thomas Eichelmann was elected to Wirecard's supervisory board. Eichelmann previously had not only been CFO of Germany's Stock Exchange Corporation but also chairman of the supervisory board of Germany's construction giant Hochtief AG until September 2014, where Russian oligarch Oleg Deripaska made a big investment around 2007 in order to coordinate gigantic construction projects for the Russian 2014 winter olympics city Sochi. In addition, another Austrian became member of Wirecard's supervisory board from 2010 on: Stefan Klestil, whom Eichelmann certainly knew well from the EU-funded IT-investment company Speedinvest. There, Stefan Klestil is/was a full and Eichelmann a limited partner. Stefan Klestil, son of former and 2004 died Austrian Federal President Thomas, whose funeral was attended by Russian President Vladimir Putin, has a stepmother who, after the death of her 1998 married husband, was made Austrian Ambassador to Moscow from 2009 on, coincidentally also until 2014.

Special attention should also be paid to Christopher Bauer, who acted as a Wirecard partner from Manila and was responsible for around a fifth of all sales. Bauer's family in Germany announced in August 2020 that he had allegedly died of heart failure in the Philippines, no official death certificate was issued according to the authorities there.

In October 2020, the German Bundestag decided to investigate the Wirecard matter. During this investigation, a whole new series of events surfaced, which to this day are either suppressed or completely ignored - almost like those at Munich's Public Prosecutor's Office. The methods used at some highest political levels and with the help of Bavarian brute force aimed at making Wirecard grow under all and any circumstances, it seems. The political debris of the Wirecard scandal also proofs that Germany had almost entirely missed the emergence of the IT industry in the decades before, with the rare exception of SAP maybe.

Details show that Germany's Finance Ministry in Berlin was informed already on February 19, 2019 about Wirecard's fraudulent acts. State Secretary Kukies told Finance Minister Olaf Scholz's employees back then that their sub-organisation BaFin was "investigating [Wirecard] in all directions". It is astonishing that even by November 2019, when all financial flags regarding Wirecard were already in deep red, Kukies met with Wirecard's CEO Markus Braun for breakfast in Aschheim, apparently chatting about startups and cryptoassets there.

Perhaps all this was possible because of German Chancellor Merkel's trip to China two months earlier, where the last and final act of the Wirecard grand poker game took place. In discussions with Chinese business representatives in September 2019 in China, the German Chancellor unabashedly promoted Wirecard, which shortly after made an offer to buy the Chinese online payment provider AllScore.

Germany's former national intelligence coordinator Klaus-Dieter Fritsche enabled Wirecard a contact with Berlin's chancellery after he learned that CEO Markus Braun "regularly goes in and out of the Austrian chancellery" in Vienna, this via the think tank "Think Austria".

During her trip to China in September 2019, Merkel also visited the glorious city of Wuhan by the way, a whole three months before the first COVID cases were reported there. Was the German Chancellor aware that 120 German Bundeswehr soldiers together with 90 medical Chinese army members carried out the military exercise 'Combined Aid' only a few months earlier in July 2019 in Feldkirchen, a small town not too far from Munich ? The German-Chinese aligned military excercise on Bavarian soil was training on how to respond to a virus pandemic for 14 days.

Long before the Chancellor's trip to China, Karl-Theodor zu Guttenberg, Germany's former Bavarian-born defense minister who lives in the US knocked on many doors. Via his New York based company Spitzberg Partners, zu Guttenberg was brought in as a lobbyist for Wirecard to enable and back up the Chinese AllScore deal. Already in September 2018, zu Guttenberg contacted the new German ambassador in Beijing through his high-profile consulting firm to promote Wirecard and its expansion in China. A first meeting was made possible for Wirecard in Beijing on October 29, 2018, a much more important meeting took place there on January 23, 2019. Days before Merkel's trip to China, zu Guttenberg had a meeting "with his former boss [Merkel] on September 3, 2019", as one of his emails details. Still in April 2020, in a written guest contribution to major German news outlet FAZ, zu Guttenberg was personally advocating for a banning of short sellers. Strangely, his name was allegedly also listed on a Wirecard campaign to promote short seller bans by German PR agency Edelmann.

On February 18, 2019, during the peak of zu Guttenberg Chinese efforts and coincidentally only one day after Munich's 2019 Security Conference had ended, Germany's regulatory banking authority BaFin issued a short sale ban to prevent financial speculations on Wirecard's falling share prices. At the same time, Munich's prosecutors announced they would now investigative Financial Times journalists, including Dan McCrum. Two months later, on April 19, 2019, BaFin announced that the eight weeks earlier imposed short sale ban had now expired, which is when BaFin also filed a criminal complaint at Munich's public prosecutor's office for

Exactly on that same February 18, 2019, coincidentally one day after the end of Munich's Security Conference, Wirecard was informed about a list of 343 suspicious financial transactions that were identified as potential money launderings.

Exactly on the same February 18, 2019, coincidentally one day after the end of Munich's Security Conference in the Hotel Bayerischer Hof, Wirecard in Aschheim was informed about a list of 343 suspicious financial transactions that were identified as potential money launderings by Commerzbank, an executing partner of Wirecard's banking arm. In the Commerzbank email, Wirecard was asked to comment on these suspicious transactions, which was probably not considered as really important any more in view of the short sale ban imposed by BaFin on exactly the same February 18, 2019. Commerzbank forwarded the list eight days later to Germany's anti money laundering unit called FIU, which, according to strange statements by FIU managers in the Wirecard Bundestag committee from June 8, 2021, did not inform Munich's public prosecutors about these 343 transactions until July 2020, while at the same time providing "seven foreign supervisory authorities with spontaneous information" in advance.

It is obvious that the public prosecutors in Munich rushed to investigate all possible players at the poker table aside from the actual corrupt ones, circumstances which lead to a special invitation for important justice officials from Munich and Bavaria to testify in front of the Bundestag Committee. At the end of January 2021, the Bavarian Minister of the Interior appears in front of the Wirecard committee, who dares to mention to an astonished audience that it "would make sense for a company like Wirecard AG to be the subject of extensive supervision".

It is also unveiled that a former Bavarian State Police President was employed by Wirecard from 2014 on. He supported a number of high-level contacts with politicians and consulates, including various police authorities. The retired and formerly highest police officer in Bavaria had multiple consulting contracts with various companies running. On January 29, 2021, one of Munich's many public prosecutors appeared in front of the German Bundestag committee. She stated among other that Marsalek's lawyer was "contacted" by her when the missing 1.9 billion Euros on Wirecard's balance sheets were confirmed mid 2020. She "invited" him to visit her Public Prosecutor's Office, which apparently happened only a week later since Wirecard told her that Mr. Marsalek was once again on a business trip. A first and quick inspection of the Prinzregentenstrasse 61 residence was carried out by Munich's public prosecutors on June 5, 2020, a real examination and search was not carried out until July 1, 2020, Marsalek and Vucak's villa was left untouched for almost a month.

A somewhat dubious affidavit from early 2019 shows that a former drug offender was apparently asked by Wirecard to state to Munich's public prosecutors that the Financial Times had allegedly offered Bloomberg News Service 6 million Euros. This, according to the affadavit, to demonstrate that Bloomberg was not only forced to run with FT-McCrum's reporting, but also that Bloomberg would blackmail Wirecard now. The affidavit was never really signed. However, Munich's public prosecutors wrote an important note to Germany's banking supervisory authority and even explained the affadavit in a more detailed telephone call to Bafin.

Munich's prosecutors gave also no prosecutorial importance to extensive investigations by local Munich tax authorities Finanzamt, which they met with in the first month of 2020. In a protocol dated January 24, 2020, the state financial auditors wrote that "the disputed issue was presented [to Munich's public prosecutors] and it was discussed if the Financial Times allegations had to be investigated". Munich's state attorneys stated still in January of 2020 that "in summary,

The State Attorneys stated still in January of 2020 that "in summary, there is no sufficient suspicion to justify the initiation of criminal proceedings here", all while FT journalists were investigated by Munich's public prosecutors.

The financial auditors at Ernst & Young (EY) appear at the center of the fraud, since they are accused of having signed off Wirecard's balance sheets too easily from 2015 on despite early and serious doubts about the company's proof of work. Wirecard's third-party business partners in Asia were entitled to receive securities from the Aschheim AG, allegedly via overseas trust accounts which continued to grow over the years, ultimately amounting to a whopping 1.9 billion euros according to the balance sheets. EY refused to certify their audit for 2019 only when proof of such trusted money accounts was more or less impossible in 2020. Strange also that auditors/laywers at EY themselves had the idea of utilizing these offshore trust accounts and recommended them to Wirecard's former Chief Legal Officer Burkhard Ley already in 2016. Munich's public prosecutor's office would not begin their investigations specifically targeted at EY until December 2020. In addition, a special audit investigator was appointed by the Bundestag committee.

Interesting also that Wirecard offered the Bavarian State still in April of 2020 a deal to purchase a larger quantity of anti Coronavirus face masks, it seems:

The top management of Munich's premier soccer club FC Bayern was also impressed by Wirecard, since they were literally neighbours in Munich. At the end of 2019, a three-year contract was signed between Wirecard and FC Bayern's top league Basketball team, which was about to receive a whopping 1.5 million Euros from the Aschheim AG. Wirecard was offered to become a so-called platinum partner right on time for the Basketball playoffs. The cooperation was announced on June 5, 2020, around two weeks before the officially admitted balance sheet disaster. Also, the former Bavarian state police president who was on Wirecard's payroll stated in the Bundestag investigational committee on January 28, 2021 that he participated in a meeting with Karl-Theodor zu Guttenberg at picture perfect Tegernsee. There at Tegernsee, a preferred residence for FC Bayern management cadres, some top league soccer players and local Bavarian politicians, "an attack strategy for Wirecard was explored, abstractly" and apparently in a gemuetlich get together.

The German Chancellery is also known for condemning new technologies, social media and even the Internet itself too easily and in a generalized way for uncovering facts about corruption. Investigative journalists are intentionally criminalised. If Merkel's advisors would have carefully researched Wirecard's takeover candidate in China, they would have been able to find out that there were also red flags all over AllScore, especially with one of its parent companies named 'Joy Dragon Consultants Limited', which was incorporated on June 12, 2019, it seems:

AllScore Payments is 98.24% owned by Beijing Apple Information Technology. This is made up by AllScore's management team and is 62.54% owned by Hong Kong based company Joy Dragon Consultants Limited and 28.1% owned by Shanghai Aiwu Investment Management Co. Ltd., which is not directly related to the current AllScore management team ... It is unclear why AllScore, a partner of the Bank of China, was chosen. They have already attracted negative attention several times in the past years. A total of 16 criminal violations include money laundering, breach of reserve requirements, unlawful dissolution of payment services, support of illegal platforms, violation of the KYC requirements, withholding of information, and many other violations ... Several minor penalties against [AllScore's] CEO Lin Yao and other directors have also accumulated in recent years.

(Report by Techkou.net dated 4. August 2020)

(Report by Techkou.net dated 4. August 2020)

That no one had any idea of Wirecard's and even AllScore's rather rough past in all these high-level political get togethers, conversations and interactions seems unreal. The fact that nobody had truly been informed about the financial problems that were boiling on Wirecard's balance sheets was clearly staged by players from Munich.

Or was it all just a daring poker game ?

Leave a comment:

Send

Send

Recommended:

Recommended:

Brilliant Consultants

About Wirecard's financial auditors and the chess game

Recommended:

BaFin The Thirteenth

An April 13th day at the Wirecard investigational committee

Recommended:

A Munich Fraud

Wirecard and Munich's Public Prosecutor's Office